Toronto, Ontario – April 26, 2023, Theralase® Technologies Inc. (“Theralase” or the “Company”) (TSXV: TLT) (OTCQB: TLTFF), a clinical stage pharmaceutical company dedicated to the research and development of light activated Photo Dynamic Compounds (“PDCs”) and their associated drug formulations intended to safely and effectively destroy various cancers released its audited annual consolidated 2022 financial statements.

Financial Summary:

For the year ended December 31st:

| Audited Consolidated Statements of Operations (In Canadian Dollars) | 2022 | 2021 | % Change |

| Revenue | |||

| Canada | 1,007,841 | 697,727 | 44% |

| United States | 112,041 | 69,725 | 61% |

| International | 18,687 | 13,189 | 42% |

| Total Revenue | 1,138,569 | 780,641 | 46% |

| Cost of Sales | 510,395 | 470,698 | 8% |

| Gross Margin | 628,174 | 309,943 | 103% |

| Gross Margin (% of revenue) | 55% | 40% | |

| Operating Expenses | |||

| Selling Expenses | 301,359 | 363,886 | -17% |

| Administrative Expenses | 1,277,253 | 1,562,867 | -18% |

| Research and Development Expenses – CLT Division | 167,365 | 308,708 | -46% |

| Research and Development Expenses – ACT Division | 4,113,741 | 2,616,025 | 57% |

| Other 1 | 3,759 | (130,482) | -103% |

| Total Operating Expenses | 5,863,476 | 4,721,004 | 24% |

| Net Loss | (5,235,302) | (4,411,061) | 19% |

Financial Highlights:

Total revenue increased 46%, year over year and is primarily attributed to the anticipated Canadian and US economic recovery from the COVID-19 pandemic in 2020 and 2021.

Cost of sales for the year ended 2022 was $510,395 (45% of revenue) resulting in a gross margin of $628,174 (55% of revenue). In comparison, the cost of sales in 2021 was $470,698 (60% of revenue) resulting in a gross margin of $309,943 (40% of revenue). The gross margin increase, as a percentage of sales, year over year, is primarily attributed to an increase in revenue at substantially the same labour and material costs.

Selling expenses for the year ended 2022, decreased to $301,359, from $363,886 in 2021 (17% decrease). The decrease in selling expenses is primarily attributed to the COVID-19 pandemic, resulting in reduced advertising (51%) and salaries (17%).

Administrative expenses for the year ended 2022, decreased to $1,277,253 from $1,562,867 in 2021, (18% decrease). The decrease in administrative expenses is primarily attributed to decreased spending on professional fees (36% decrease), insurance expenses (7% decrease) and stock-based compensation (63% decrease).

Net research and development expenses for the year ended 2022, increased to $4,281,106 from $2,924,733 in 2021 (46% increase). The increase in research and development expenses is primarily attributed to the costs related to the Phase II Non-Muscle Invasive Bladder Cancer (“NMIBC”) clinical study (“Study II”). Research and development expenses represented 73% of the Company’s operating expenses and represents investment into the research and development of the Company’s Anti-Cancer Therapy (“ACT”) technology.

The net loss for the year ended 2022 was $5,235,302 which included $554,298 of net non-cash expenses (i.e.: amortization, stock-based compensation expense and foreign exchange gain/loss). This compared to a net loss in 2021 of $4,411,061 which included $618,586 of net non-cash expenses. The ACT division represented $4,708,874 of this loss (90%) for the year ended December 31, 2022. The increase in net loss is primarily attributed to increased spending in research and development expenses in Study II.

Operational Highlights:

- TSX Venture 50TM

Theralase® was named to the Toronto Stock Exchange Venture (“TSXV”) “2023 Venture 50™”. The Venture 50™ is an annual ranking of the top-performing companies from five industry sectors; specifically: Clean Technology and Life Sciences, Diversified Industries, Energy, Mining and Technology. Theralase® was recognized in the Clean Technology and Life Sciences category. Theralase® was previously named a 2015, 2019 and 2020 Venture 50™ company making this the fourth year Theralase® has been recognized as a top performer in the Clean Technology and Life Sciences sector in the last 8 years.

- Non-Brokered Private Placements

On September 22, 2022, the Company completed a non-brokered private placement financing, where 10,000,000 Units were issued at a price of $0.25 per Unit for gross proceeds of $2,500,000. Each Unit consisted of 1 common share and 1 non-transferable common share purchase warrant. Each whole warrant entitles the holder to acquire 1 common share at a price of $0.35, expiring on September 22, 2024. An aggregate of 2,400,000 Units, representing gross proceeds of $600,000, were issued to certain insiders of the Corporation.

On November 17, 2022, the Company completed a non-brokered private placement financing, where 1,000,000 Units were issued at a price of $0.25 per Unit for gross proceeds of $250,000. Each Unit consisted of 1 common share and 1 non-transferable common share purchase warrant. Each whole warrant entitles the holder thereof to acquire 1 common share at a price of $0.35, expiring on November 17, 2024. An aggregate of 511,000 units, representing gross proceeds of $127,750, were issued to certain insiders of the Corporation.

- TLD-1433 (Trade Name: Ruvidar TM)

The trade name RuvidarTM was selected by the Company for its lead PDC, TLD-1433; where, Ru is the elemental symbol for Ruthenium (a rare transitional eight metal belonging to the platinum group, which the Theralase® PDC is based upon), vita is Latin for “life” and dar is Russian for “gift”; hence, roughly translated, “Ruthenium, the gift of life”.

- Break Through Designation (“BTD”) Update

In 2021, Theralase® completed its first significant milestone of Study II by enrolling and providing the primary study treatment for 25 patients. In 2022, Theralase® completed its second significant milestone of Study II by enrolling and providing the primary study treatment for 50 patients. The Company is currently working with both a biostatistics and regulatory organization to compile a clinical data report for submission to the FDA in support of the grant of a BTD approval.

To date, Study II has provided the primary study treatment for 57 patients.

Note: To be included in the statistical clinical analysis a patient must be enrolled in Study II, provided the primary Study Treatment and evaluated by a Principal Investigator (“PI”) at the 90 day assessment visit (cystoscopy and urine cytology)

Note: One patient passed away prior to their 90 day assessment and is not included in the statistical analysis. Four patients have been enrolled and provided the primary Study Treatment, but have not been evaluated at their 90 day assessment; therefore, only 52 patients are considered Evaluable Patients at 90 days.

In an analysis of Evaluable Patients, Study II clinical data provides the following interim analysis:

| Assessment | 90 Day | 180 Day | 270 Day | 360 Day | 450 Day |

| Complete Response (“CR”) | 54% | 62% | 56% | 43% | 67% |

| Indeterminate Response (“IR”) | 12% | 22% | 22% | 10% | 17% |

| Total Response (“CR + IR”) | 65% | 84% | 78% | 52% | 83% |

| Evaluable Patients | 52 | 37 | 27 | 21 | 12 |

The interim clinical data demonstrates a 90 days CR of 54% (n=52) and a sustained duration of response at 450 days of 67% (n=12), for patients who remained in Study II.

Note: Evaluable Patients are defined as patients, who have been evaluated by a PI and thus excludes patients with assessment days pending.

Note: The current interim data analysis presented above, should be read with caution, as the clinical data is interim in its presentation, as Study II is ongoing and new clinical data collected may or may not continue to support the current trends, with significant data still pending.

Note: Patients with a negative cystoscopy and positive urine cytology were defined as Indeterminate Response (“IR”), as these patients remain under investigation for lower and/or upper tract urothelial carcinoma. Total Responders (CR and IR) are defined as CR + IR.

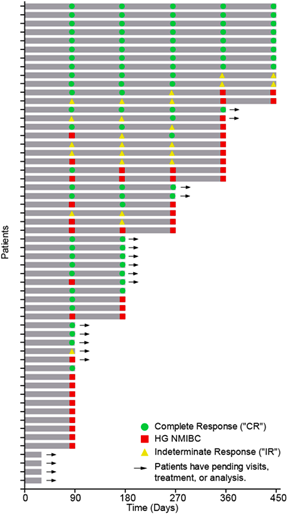

The Swimmer’s plot below is a graphical representation of the interim clinical results (n=56) showing a patient’s response to a treatment over time. As can be seen in the plot, significant data is still pending for patients who have demonstrated an initial CR at 90 days and continue to demonstrate a duration of that response at 180, 270 and 360 days.

Note: One patient passed away prior to their 90 day assessment and is not included in the statistical analysis.

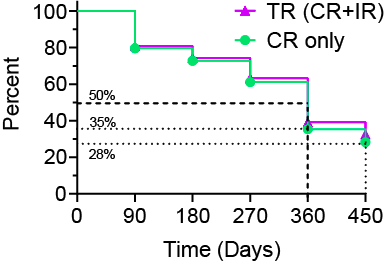

The interim Kaplan-Meier (KM) Curve below represents the cumulative incidence of clinical events, including the treatment efficacy, occurring over a prespecified time in Study II. According to the KM curve, approximately 80% of patients remained in Study II after 90 days, following the primary study treatment. More than 60 % of the treated patients have a probability to achieve the primary study objective and, slightly less than 30 % of patients have a probability to achieve a durable Complete Response (the Study II secondary endpoint) at 450 day.

- Study II Interim Data Presentations

Study II (Interim) clinical data was presented at the American Society of Clinical Oncology (“ASCO”) Genito Urinary (“GU”) Cancer Symposium on February 17, 2023 in San Francisco, California with the poster presented for general viewing and discussion within Poster Session B: Prostate Cancer and Urothelial Carcinoma. The poster presented at the ASCO GU Cancer Symposium can be found on the Company’s website at www.theralase.com/ASCO_Poster.

Study II (Interim) clinical data has been accepted by the American Urology Association (“AUA”) for a moderated poster presentation at the 2023 AUA Annual Meeting to take placebetweenApril 28th to May 1st, 2023 in Chicago, Illinois. The poster will be presented for general viewing and discussion at a moderated poster session, during the AUA Annual Meeting. The poster presented at the AUA Annual Meeting can be found on the Company’s website at www.theralase.com/AUA_Poster.

About Study II

Study II utilizes the therapeutic dose of TLD-1433 (0.70 mg/cm2) activated by the proprietary TLC-3200 medical laser system. Study II is focused on enrolling and treating approximately 100 to 125 BCG-Unresponsive NMIBC Carcinoma In-Situ (“CIS”) patients in up to 20 Clinical Study Sites (“CSS”) located in Canada and the United States.

About TLD-1433 (RuvidarTM)

TLD-1433 is a patented PDC with 12 years of published peer reviewed preclinical research and is currently under investigation in Study II.

About Theralase® Technologies Inc.

Theralase® is a clinical stage pharmaceutical company dedicated to the research and development of light activated compounds and their associated drug formulations with a primary objective of efficacy and a secondary objective of safety in the destruction of various cancers, bacteria and viruses.

Additional information is available at www.theralase.com and www.sedar.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statement

This news release contains “forward-looking statements” within the meaning of applicable Canadian securities laws. Such statements include, but are not limited to, statements regarding the Company’s proposed development plans with respect to Photo Dynamic Compounds and their drug formulations and a COVID-19 vaccine. Forward looking statements may be identified by the use of the words “may, “should“, “will“, “anticipates“, “believes“, “plans“, “expects“, and similar expressions including statements related to the current expectations of Company’s management for future research, development and commercialization of the Company’s COVID vaccine, including preclinical research, clinical studies and regulatory approvals.

These statements involve significant risks, uncertainties and assumptions; including, the ability of the Company to: adequately fund, and secure the requisite regulatory approvals to successfully complete clinical studies for a COVID-19 vaccine in a timely fashion and implement its development plans. Other risks include: the ability of the Company to successfully commercialize its drug formulations, the risk that access to sufficient capital to fund the Company’s operations may not be available or may not be available on terms that are commercially favorable to the Company, the risk that the Company’s drug formulations may not be effective against the diseases tested in its clinical studies, the risk that the Company’s fails to comply with the term of license agreements with third parties and as a result loses the right to use key intellectual property in its business, the Company’s ability to protect its intellectual property, the timing and success of submission, acceptance and approval of regulatory filings, and the impacts of public health crises, such as COVID-19. Many of these factors that will determine actual results are beyond the Company’s ability to control or predict.

Readers should not unduly rely on these forward- looking statements which are not a guarantee of future performance. There can be no assurance that forward looking statements will prove to be accurate as such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results or future events to differ materially from the forward looking statements.

Although the forward-looking statements contained in the press release are based upon what management currently believes to be reasonable assumptions, the Company cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements.

All forward-looking statements are made as of the date hereof and are subject to change. Except as required by law, the Company assumes no obligation to update such statements.

For More Information:

1.866.THE.LASE (843-5273)

416.699.LASE (5273)

www.theralase.com

Kristina Hachey, CPA

Chief Financial Officer

khachey@theralase.com

416.699.LASE (5273) x 224