Toronto, Ontario – November 29, 2022, Theralase® Technologies Inc. (“Theralase” or the “Company”) (TSXV: TLT) (OTCQB: TLTFF), a clinical stage pharmaceutical company dedicated to the research and development of light activated Photo Dynamic Compounds (“PDC”) and their associated drug formulations intended to safely and effectively destroy various cancers, bacteria and viruses has released the Company’s unaudited 3Q2022 condensed interim consolidated Financial Statements (“Financial Statements”).

Financial Highlights:

For the six-month period ended September 30th:

| Audited Consolidated Statements of Operations In Canadian Dollars | 2022 | 2021 | % Change |

| Revenue | |||

| Canada | 683,167 | 501,523 | 36% |

| United States | 111,496 | 52,100 | 114% |

| International | 18,335 | 13,189 | 39% |

| Total Revenue | 812,998 | 566,812 | 43% |

| Cost of Sales | 389,232 | 317,397 | 23% |

| Gross Margin | 423,766 | 249,415 | 70% |

| Gross Margin as a percentage of sales | 52% | 44% | |

| Operating Expenses | |||

| Selling Expenses | 238,904 | 271,708 | -12% |

| Administrative Expenses | 1,068,979 | 1,211,834 | -12% |

| Research and Development Expenses – CLT Division | 133,959 | 254,228 | -47% |

| Research and Development Expenses – ACT Division | 3,330,705 | 1,782,187 | 87% |

| Other(1) | 3,319 | (140,811) | 102% |

| Total Operating Expenses | 4,775,866 | 3,379,146 | 41% |

| Net Loss | (4,352,100) | (3,129,731) | 39% |

Total revenue increased 43%, year over year and is primarily attributed to the anticipated Canadian and US economic recovery from the COVID-19 pandemic in 2020 and 2021.

Cost of sales for the nine-month period ended September 30, 2022 was $389,232 or 48% of revenue resulting in a gross margin of $423,766 or 52% of revenue. In comparison, the cost of sales in 2021 was $317,397 or 56% of revenue resulting in a gross margin of $249,415 or 44% of revenue. Cost of sales is represented by the following costs: raw materials, subcontracting, direct and indirect labour and the applicable share of manufacturing overhead.

Selling expenses for the nine-month period ended September 30, 2022, decreased to $238,904, from $271,708 in 2021, a 12% decrease. The decrease in selling expenses is primarily attributed to the COVID-19 pandemic, resulting in reduced advertising (51%), and salaries (15%).

Administrative expenses for the nine-month period ended September 30, 2022, decreased to $1,068,979 from $1,211,834 in 2021, a 12% decrease. The decrease in administrative expenses is primarily attributed to decreased spending on professional fees (28%) and insurance (12%). Stock based compensation expense decreased 62% in 2022 due to a reduction in stock options granted.

Net research and development expenses for the nine-month period ended September 30, 2022, increased to $3,464,664 from $2,036,415 in 2021, a 70% increase. The increase in research and development expenses is primarily attributed to the costs related to the Phase II Non-Muscle Invasive Bladder Cancer (“NMIBC”) clinical study (“Study II”). Research and development expenses represented 73% of the Company’s operating expenses and represents investment into the research and development of the Company’s Anti-Cancer Therapy (“ACT”) technology.

The net loss for the nine-month period ended September 30, 2022 was $4,352,100, which included $391,321 of net non-cash expenses (i.e.: amortization, stock-based compensation expense and foreign exchange gain/loss). This compared to a net loss in 2021 of $3,129,731 which included $486,010 of net non-cash expenses. The ACT division represented $3,820,222 of this loss (88%) for the nine-month period ended September 30, 2022.

The increase in net loss is primarily attributed to increased spending in research and development expenses in Study II.

Operational Highlights:

1.)Non-Brokered Private Placement. On September 22, 2022, the Company completed a financing by way of a non-brokered private placement, where 10,000,000 units were issued at a price of $0.25 per unit for gross proceeds of $2,500,000. Each unit consisted of 1 common share and 1 non-transferable common share purchase warrant. Each whole warrant entitles the holder thereof to acquire 1 common share at a price of $0.35, expiring on September 22, 2024. An aggregate of 2,400,000 units, representing gross proceeds of $600,000, were issued to certain insiders of the Corporation.

On November 17, 2022, the Company completed a financing by way of a non-brokered private placement, where 1,000,000 units were issued at a price of $0.25 per unit for gross proceeds of $250,000. Each unit consisted of 1 common share and 1 non-transferable common share purchase warrant. Each whole warrant entitles the holder thereof to acquire 1 common share at a price of $0.35, expiring on November 17, 2024. An aggregate of 511,000 units, representing gross proceeds of $127,750, were issued to certain insiders of the Corporation.

2.)Break Through Designation Update. In 2021, Theralase® completed its first significant milestone of Study II by enrolling and treating 25 patients. The Company will compile a clinical data report for submission to the FDA in support of the grant of a BTD approval after completion of the 450 assessments for 25 patients, expected in 4Q2022, subject to the CSS’s availability to complete all required assessments and biostatistical review and analysis.

3.)COVID-19 Pandemic Update. In the ACT division, the Company continues to experience delays in patient enrollment and treatment rates in Study II due to the ongoing COVID-19 pandemic; however, these rates have improved as Canada and the US commence their recovery from the business and economic impacts of the COVID-19 pandemic.

4.)Clinical study site status and update. To date, Study II has provided the primary study treatment for 51 patients (including three patients from the Phase Ib NMIBC Clinical Study treated at the Therapeutic Dose for a total of 54 patients.

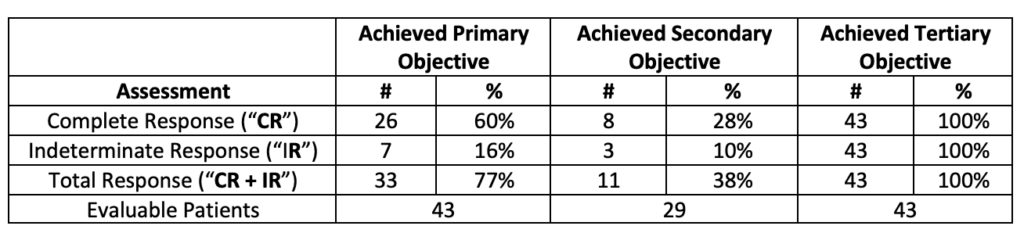

An analysis of Evaluable Patients (defined as patients who have been evaluated by the principal investigator and thus excludes data pending), in Study II provides the following interim analysis (including three patients from the Phase Ib NMIBC Clinical Study treated at the Therapeutic Dose):

Note: The Primary Objective CR is determined at any point in time (defined above under Study II Objectives). CR was achieved as follows: 23 patients at 90 days, 1 patient at 180 days and 2 patients at 270 days.

Note: Indeterminate Response (“IR”), previously referred to as Partial Response, is defined as patients assessed with negative cystoscopy and suspicious or positive urine cytology.

| Assessment | 90 Day | 180 Day | 270 Day | 360 Day | 450 Day |

| Complete Response (“CR”) | 53% | 45% | 41% | 29% | 28% |

| Indeterminate Response (“IR”) | 14% | 24% | 19% | 15% | 10% |

| Total Response (“CR + IR”) | 67% | 69% | 60% | 44% | 38% |

| Evaluable Patients | 43 | 38 | 37 | 34 | 29 |

The clinical data to date demonstrates a strong initial CR (53%) and a strong duration of that response for 450 days (28%).

In accordance with the FDA’s 2018 guidelines to industry, the patients who have achieved an Indeterminate Response (“IR”) are being further assessed via Computerized Tomography (“CT”) scan and/or biopsy of the prostatic urethra to determine if upper tract Urothelial Cell Carcinoma (“UCC”) or prostatic urethra UCC can be detected to allow these patients to be re-categorized as CR.

Note: The current interim data analysis presented above, should be read with caution, as the clinical data is interim in its presentation, has not been formally reviewed by Health Canada and/or the FDA, as Study II is ongoing and new clinical data collected may or may not continue to support the current trends, with significant data still pending.

5.)Additional cancer indications. The Company has demonstrated significant anti-cancer efficacy of Rutherrin®, when activated by laser light or radiation treatment across numerous preclinical models; including: Glio Blastoma Multiforme (“GBM”) and Non-Small Cell Lung Cancer (“NSCLC”). The Company has commenced Non – Good Laboratory Practices (“GLP”) toxicology studies with Rutherrin® in animals to help determine the maximum recommended human dose of the drug, when administered systemically into the human body, via intravenous injections. Theralase plans to commence GLP toxicology studies in animals in 4Q2022.

6.)COVID-19 Research Update. In February 2022 Theralase® reported that Public Health Agency of Canada had demonstrated that light-activated TLD-1433, was effective in rapidly inactivating the SARS-CoV-2 virus by up to 99.99%, compared to control in an in vitro study. Further research is required to confirm these findings.

In July 2022, Theralase® executed a Testing and Technical Services Agreement (“TTSA”) with the National Research Council of Canada (“NRC”) to produce inactivated SARS-CoV-2 virus using Theralase®’s patented PDC and proprietary TLC-3000B medical laser system technology. This inactivated virus will be used to create a vaccine to vaccinate animals to determine the immunogenicity effects of the TLD-1433 SARS-CoV-2 (COVID-19) vaccine and assess its efficacy in protecting the animals from contracting SARS-CoV-2 during SARS-CoV-2 challenge.

Theralase® is currently designing and developing a new proprietary light activation platform; specifically, the TLC-3000B, to inactivate the virus and create the fundamental building blocks of a COVID-19 vaccine. The TLC-3000B is expected to be completed for use by PHAC and NRC in 1Q2023.

The above results and completion of the TLC-3000B will lay the groundwork for the next phase of the CRA and TTSA, which is evaluating the Theralase® COVID-19 vaccine in the ability to prevent animals from contracting COVID-19, at two world class laboratories, when exposed to the virus, which is expected to commence in 1Q2023 and be completed by 1Q2024.

Note: The Company does not claim or profess that they have the ability to treat, cure or prevent the contraction of the COVID-19 coronavirus.

About Study II

Study II utilizes the therapeutic dose of TLD-1433 (0.70 mg/cm2) activated by the proprietary TLC-3200 medical laser system. Study II is focused on enrolling and treating approximately 100 to 125 BCG-Unresponsive NMIBC Carcinoma In-Situ (“CIS”) patients in up to 15 Clinical Study Sites (“CSS”) located in Canada and the United States.

About TLD-1433

TLD-1433 is a patented PDC with over 10 years of published peer reviewed preclinical research and is currently under investigation in Study II.

About Theralase® Technologies Inc.

Theralase® is a clinical stage pharmaceutical company dedicated to the research and development of light activated compounds and their associated drug formulations with a primary objective of efficacy and a secondary objective of safety in the destruction of various cancers, bacteria and viruses.

Additional information is available at www.theralase.com and www.sedar.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statement

This news release contains “forward-looking statements” within the meaning of applicable Canadian securities laws. Such statements include, but are not limited to, statements regarding the Company’s proposed development plans with respect to Photo Dynamic Compounds and their drug formulations and a COVID-19 vaccine. Forward looking statements may be identified by the use of the words “may, “should“, “will“, “anticipates“, “believes“, “plans“, “expects“, and similar expressions including statements related to the current expectations of Company’s management for future research, development and commercialization of the Company’s COVID vaccine, including preclinical research, clinical studies and regulatory approvals.

These statements involve significant risks, uncertainties and assumptions; including, the ability of the Company to: adequately fund, and secure the requisite regulatory approvals to successfully complete clinical studies for a COVID-19 vaccine in a timely fashion and implement its development plans. Other risks include: the ability of the Company to successfully commercialize its drug formulations, the risk that access to sufficient capital to fund the Company’s operations may not be available or may not be available on terms that are commercially favorable to the Company, the risk that the Company’s drug formulations may not be effective against the diseases tested in its clinical studies, the risk that the Company’s fails to comply with the term of license agreements with third parties and as a result loses the right to use key intellectual property in its business, the Company’s ability to protect its intellectual property, the timing and success of submission, acceptance and approval of regulatory filings, and the impacts of public health crises, such as COVID-19. Many of these factors that will determine actual results are beyond the Company’s ability to control or predict.

Readers should not unduly rely on these forward- looking statements which are not a guarantee of future performance. There can be no assurance that forward looking statements will prove to be accurate as such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause actual results or future events to differ materially from the forward looking statements.

Although the forward-looking statements contained in the press release are based upon what management currently believes to be reasonable assumptions, the Company cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements.

All forward-looking statements are made as of the date hereof and are subject to change. Except as required by law, the Company assumes no obligation to update such statements.

For More Information:

1.866.THE.LASE (843-5273)

416.699.LASE (5273)

www.theralase.com

Kristina Hachey, CPA

Chief Financial Officer

khachey@theralase.com

416.699.LASE (5273) x 224